reit dividend tax rate 2021

Any money distributed by an InvIT or REIT like interest dividend or rental income for REITs is taxable at the slab rate applicable to the unitholder The trust deducts tax TDS on such money at 10 for residents. Fundrise just delivered its 21st consecutive positive quarter.

However REIT dividends will qualify for a lower tax rate in the following instances.

. Generally dividends from REITs are automatically exempt from being qualified dividends. In addition this department collects annual sewer fees. This portion of qualified dividends gets taxed at lower capital gains rates.

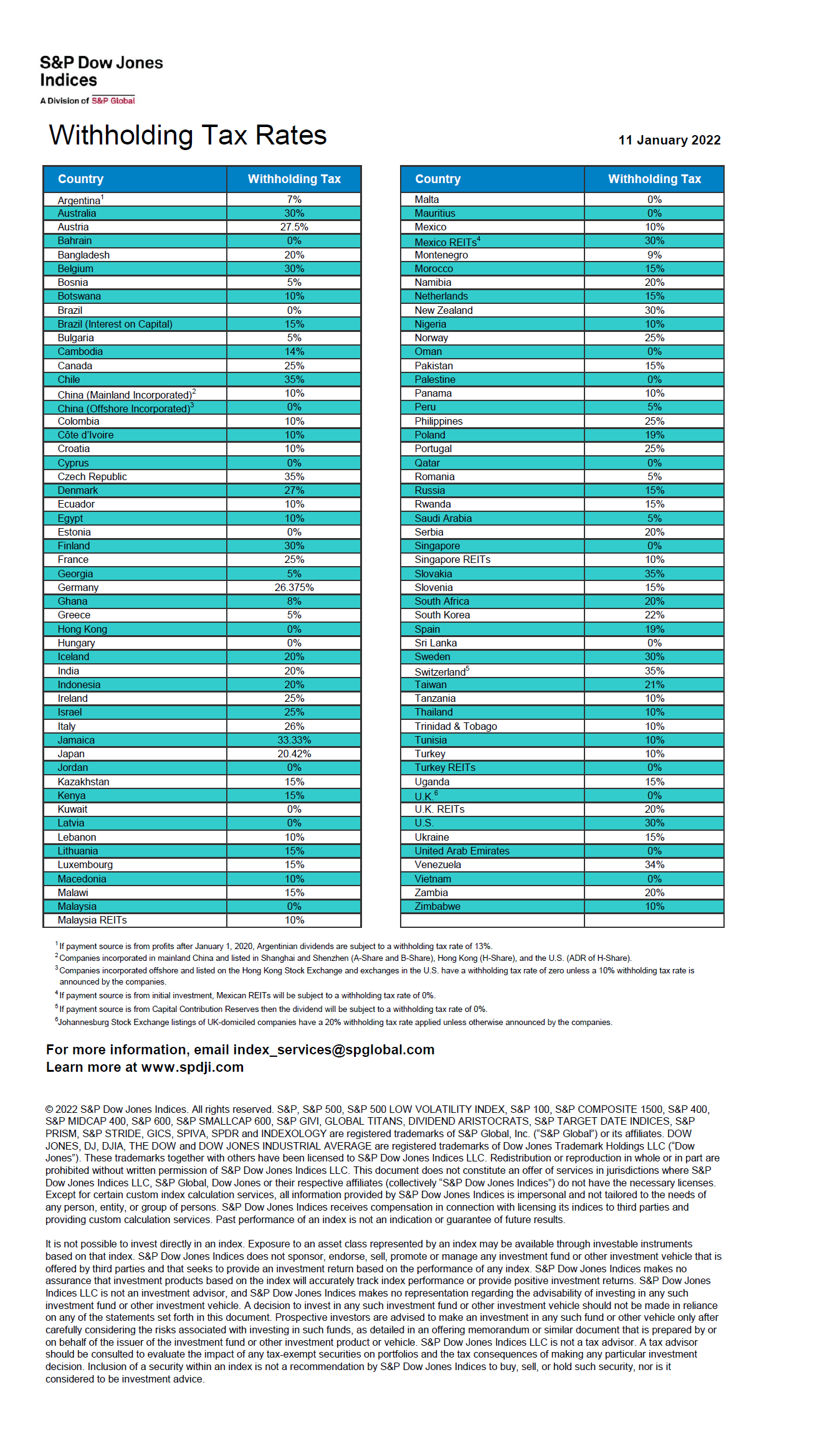

For 2021 these rates remain unchanged from 2020. Singapore is one of the few countries in the world that charges no withholding taxes to US residents. 1 As the Companys aggregate 2021 cash distributions exceeded its 2021 earnings and profits the January 2022 cash distribution declared in the fourth quarter of 2021 will.

To see why consider the Cohen Steers Quality Income Realty Fund RQI. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. While RICs can pass through qualified REIT dividends to their shareholders investors may in some situations be able to benefit from investing in the same.

The government requires REITs to abide by several regulations including maintaining 75 of their assets and income in real estate and having a minimum of 100 shareholders. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders. 830 tax rate if shareholder owns 25 or more of the REITs stock.

915 tax rate if shareholder owns more than 50 of the REITs voting stock. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. The post 3 REITs Growing Their Dividends at a High Rate appeared first on.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen. To work out your tax band add your total dividend income to. A real estate investment trust or REIT is essentially a mutual fund for real estate.

Its manager Cohen Steers is a well-respected investment shop thats been around and focusing on REITs since 1986. These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies. 25 May 2021.

There are two instances when your REIT will encounter capital gains taxes. As a result the company is exempt from paying income taxes on the profits paid. And the shareholders are subjected to tax on the dividends irrespective of the rate of tax paid by the company.

However the income thresholds for each bracket have been adjusted to account for inflation. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. Geo Overview Real Estate Investment Trust Investment Portfolio Real Estate Investing A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends.

The company expects 2021 to be another year of growth with management forecasts calling for 10 growth in AFFO. The trusts can now raise debt capital at competitive rates while dividend payment to REITs and InVITs have been exempt from tax. 1What is the 2021 Singapore Withholding Tax Rate for Dividends paid to US investors.

When the individual taxpayer is subject to a lower scheduled income tax rate. In addition REITs must distribute 90 of their earnings to shareholders through dividends. Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates.

A ReitInvIT can therefore effectively give investors a. Tax rate on dividends over the allowance. Reit dividend tax rate 2021 Thursday March 17 2022 Edit.

REITs and Capital Gains Taxes. Taking into account the 20 deduction the highest effective tax rate on Qualified REIT Dividends is typically 296. 710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest.

According to the National Association of Real Estate Investment Trusts commonly referred to as Nareit the dividend yield across all REITs was nearly 4 in November 2019. Union Budget 2021 India. Make changes to your 2021 tax return online for up to 3 years after it has been filed.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. 4What is the 2021 Withholding Tax Rate for REITs. 199A allows taxpayers to deduct 20 of their qualified REIT dividends.

First a capital gains qualifying event occurs if the REIT sells property that it has owned and managed. Long-term capital gains are. When a REIT makes a capital gains distribution 20 maximum tax rate plus the 38 surtax or a.

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to. Singapore Dividend Withholding Tax. Among equity REITs the.

5Is there anyway to get a reduced Withholding Tax Rate.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

.png)

Tax On Dividends Calculator Sale 48 Off Www Otsv De

Tax On Dividends Calculator Store 41 Off Www Otsv De

Tax On Dividends Calculator Sale 48 Off Www Otsv De

Tax Efficient Etf Investing Justetf

Sec 199a And Subchapter M Rics Vs Reits

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Tax On Dividends Calculator Sale 48 Off Www Otsv De

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Dividend Withholding Tax Rates By Country For 2022 Topforeignstocks Com

What Stock Market History Tells Us About Corporate Tax Hikes In 2021 Stock Market Stock Market History Corporate Tax Rate

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

How Are Dividends Taxed Overview 2021 Tax Rates Examples

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends